Annual report from HMS Networks projects continued growth for industrial networks despite pandemic, and industrial network market shares to grow by 6% in 2021.

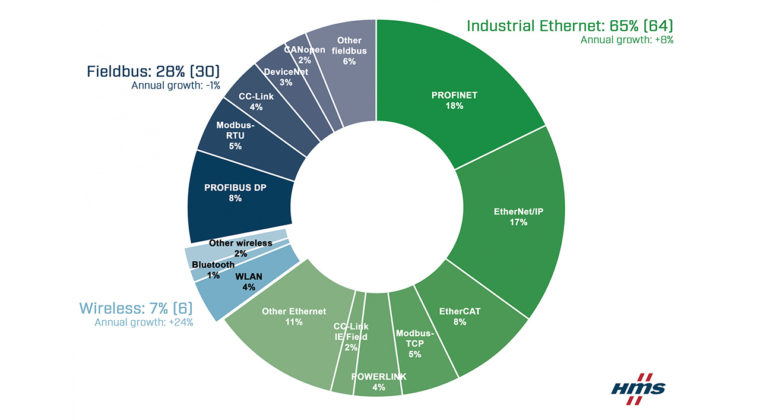

A study regarding industrial network market which analyses the distribution of new connected nodes in factory automation was carried out by HMS Networks every year. In this year study even with the Corona pandemic the industrial network market is to be expected to grow by 6% in 2021. Industrial Ethernet still shows the highest growth and now has 65% of new installed nodes (64% last year), while fieldbuses are at 28% (30). Wireless networks continue to climb and are now at 7%. PROFINET passes EtherNet/IP at the top of the network rankings with 18% market share compared to 17%.

By focusing on new installed nodes in the factory automation globally HMS Networks is presenting their annual analysis of the Industrial network market. HMS Network has a substantial insight into the industrial network market as an independent supplier of solutions in Industrial ICT (Information and Communication)The growth rates and market shares for fieldbus, industrial ethernet and Wireless technologies is also included in the 2021 study of HMS Networks. It also includes the signs of stability in the industrial network and the expected total market will grow by 6% in 2021 by HMS.

Industrial Ethernet is growing steadily

Industrial Ethernet will continue to take the market share by growing 8%. The new installed nodes in Factory Automation makes up to 65% of the global market compared to the 64% last year. Ranking with 18% market share compared to 17% as the PROFINET passes EtherNet/Ip at the top of the network. The EtherCAT has lead the fieldbus PROFIBUS at 8% market share.

Fieldbus decline halted

HMS has reported the ongoing fieldbus in this recent years which almost halted with a fieldbus decrease of only -1% in 2021, a the pandemic occurred the the factories tend to stick to the existing technologies to a hiher degree in uncertain times. The total amount of new installed nodes in fieldbus is at 28%. At 8% the PROFIBUS is leading the fieldbus which is followed by Moodbus-RTU at 5% share and CC-Links at 4%.

Wireless is here to stay

The rapid grow of wireless at the rate of 24%. With the market share of wireless at 7% the market still awaits the full impact of 5G in factories. The global activities regarding wireless cellular technologies as the enablers for the next level smart manufacturing. The demand for wireless connected devices is expected to have a market demand and machines is to be included in the less cabled and flexible automation architectures of the future according to HMS.

Smart and sustainable manufacturing requires networking

“Industrial network connectivity for devices and machines is key to obtain smart and sustainable manufacturing, and this is the main driver for the growth we see in the industrial networking market,” says Anders Hansson, Chief Marketing Officer at HMS Networks. “Factories are constantly working to optimize productivity, sustainability, quality, flexibility and security. Solid industrial networking is key to achieving these objectives.”

Regional network variations

With the EtherNet/IP and PROFINET leading in Europe and Middle East with PROFIBUS and EtherCAT as runner up. Other popular networks are Modbus (RTU/TCP) and Ethernet POWERLINK. The U.S. market is dominated by EtherNet/IP with EtherCAT gaining some market share. PROFINET and EtherNet/IP lead a fragmented Asian market, followed by strong contenders CC-Link/CC-Link IE Field, PROFIBUS, EtherCAT and Modbus (RTU/TCP).

Scope

The new installed nodes within Factor Automation is included in the HMS study 2021. The node is a machine or a device connected to an industrial field network with the presented figures represent HMS’ consolidated view, considering insights from colleagues in the industry, our own sales statistics and overall perception of the market.

Content inspired from Sciencedirect.com

Please contact us for further information.